What is the role of ‘sustainable’ venture capitalist in developing new sustainable start-ups?

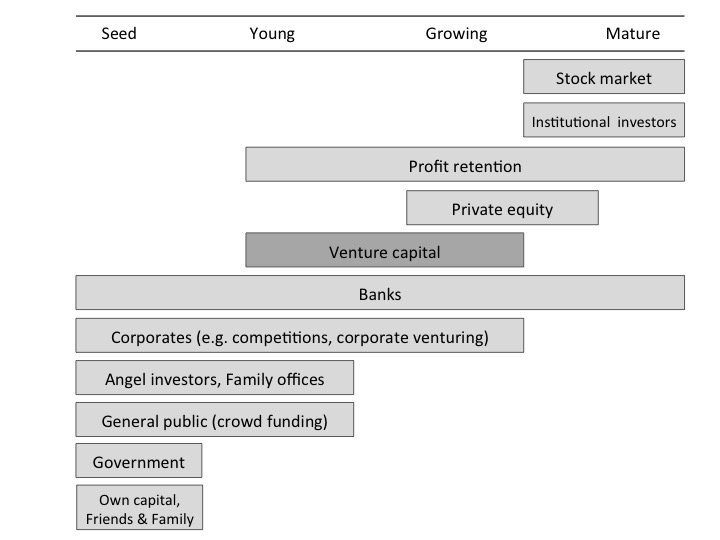

Venture capitalists have a special role to play as they usually invest during the more risky stages of doing business – when businesses are still relatively young and the business benefits are not yet fully crystalized. This research has focused on ‘pragmatic idealists’ – in short, those that want to change the world positively, but also want to make good business out of this.

Figure 1. Role of venture capital. Source: Bocken (2015) based on Marcus et al. (2013)

Key people in the industry were interviewed over a period of a couple of months in 2013. These ‘sustainable venture capitalists’ either started to work on this area because they see themselves as ‘practical idealist’, they disagree with the status quo, or they want to help mainstream sustainable businesses. Some are motivated by fear or a personal epiphany (e.g. having their first child).

Figure 2. Pragmatic idealists. Source: Bocken (2015)

Innovation in the business model, collaboration, and a strong business case were found to be key reasons for sustainable start-up success. Failure often happens due to the fact that ‘start-ups just fail’ (about 9 in 10 as mentioned by some of the experts), but a strong existing industry is also important. On the investor side, there may be only a few suitable and willing venture capitalists to invest in sustainable ventures, because of a short-term investor mindset and a search for quick-win-formats (e.g. apps).

There is plenty of opportunity for large businesses to collaborate with start-ups by acting as an R&D partner of serving as a major customer. Entrepreneurs are already challenging existing business models (e.g. Airbnb, Zipcar, and numerous new service models, and sharing models (e.g. Peerby and Yerdle), which can eventually make existing business models obsolete. There is also opportunity in new forms of financing such as crowdfunding and peer-to-peer lending. In the end venture capitalists should plan for potential slower returns, in favour of positive societal and environmental benefits.

The full article can be found here:

Bocken, N. 2015. Sustainable venture capital – catalyst for sustainable start-up success? Journal of Cleaner Production (in press) http://www.sciencedirect.com/science/article/pii/S0959652615006460 (open access)

Other sources:

Marcus, A., Malen, J., Ellis, S. 2013. The Promise and Pitfalls of Venture Capital as an Asset Class for Clean Energy Investment: Research Questions for Organization and Natural Environment Scholars. Organ. & Environ, 26 (1), 31-60.

I welcome intensive, intriguing, research of the kind reported in the paper. I do, however, have two questions for clarification:

1. in table 3, there is a reference to short-termist mindsets. (a) Who exactly is it that is said to have those mindsets? And (b) according to whom do they have these mindsets?

2. there needs to be clarity re. the definition of (social) venture capitalist. The paper tends to distinguish between (a) sustainable venture capitalist and (b) venture capitalist in general. But then there is a reference to ‘venture capitalists on accelerator programmes’: do these all come from type (a) capitalists or do some come from type (b)? It isn’t crystal clear. If they all come from type (a), it leaves open the question of how far these findings can be extended to venture capital in general.

More fundamentally, my experience suggests that there is a major gap in research on this subject. For example, this specific paper does not deal with the theme of communication. Typically I’ve found an unhelpful ontological assumption behind such research: one that assumes that investors are reacting to start-ups as pure entities, or things in themselves, whereas for much of the time investors’ perceptions are mediated by the way the start-ups are communicated – for example, through presentations, pitches, and bids.

The work of researchers such as Melanie Milovac is pertinent here: it indicates that a pitch that fails can sometimes, if written and presented differently, succeed. This certainly tallies with my own work helping people to obtain funds or win business.

I suggest, therefore, that a further limitation of the research (by no means in this paper alone) is a lack of attention to how cases are communicated – the textuality and mediation involved – and that a further implication is that this merits further (multidisciplinary) investigation.

There is a hint of this kind of thing in the comment from a financier about the ambiguity of the word ‘sustainable’ and the need for new language. How many entrepreneurs have heeded this point? Entrepreneurs need to speak to investors in the latter’s language before they can draw conclusions about what they will and won’t invest in.

Thank you!

To answer your questions:

1. This short-term mindset was reported by the investors I interviewed (predominantly, sustainable venture capitalists). They were actually quite self-critical. If investments don’t (appear to) pay off quickly, this is seen as quite a risky strategy. Hence, although they mention they typically have a more long-term view on their start-up investments than ‘conventional’ venture capitalists, they do look for clear ‘win-win’ situations, and a strong business case regardless of sustainability (27% of sample). This is their way to mitigate risks and still be able to invest in sustainable start-ups.

2. Some venture capitalists work for their own venture capital firms only and others spend most of their time working for accelerator programmes (supporting multiple start-ups through such programmes). I think this is the same for ‘conventional’ venture capitalists: some work only for their own firms, but others are also heavily (or solely) involved in accelerator programmes. In that sense, the results might apply to the ‘conventional’ venture capitalist context too. However, their investment thesis is not typically or predominantly focused on sustainability.

To your point on research communication: I think it could have been quite helpful to reframe this research based on specific cases of ‘sustainable start-ups’ and the investment approach with regards to these. Then, one could have looked at the investors perspective and the entrepreneurs perspective of ongoing sustainable start-up/ investment cases. Within these, it would have been very useful to reflect on the theme of ‘sustainability’ too. However, because most were still in progress, it is understandable that it is (a) difficult to report on these, and (b) that it isn’t seen as a very favourable thing to report on these (e.g. barriers/ opportunities) so openly.

A quantitative study about the number of entrepreneurs and investors in the sustainability space would also be most helpful. I’ve discussed this with colleagues in the past, but it still an important ‘future research’ (work to do!).

Will have a look at Melanie Milovac’s work – sounds very helpful! Many thanks for these thorough comments.