What is the role of ‘sustainable’ venture capitalist in developing new sustainable start-ups?

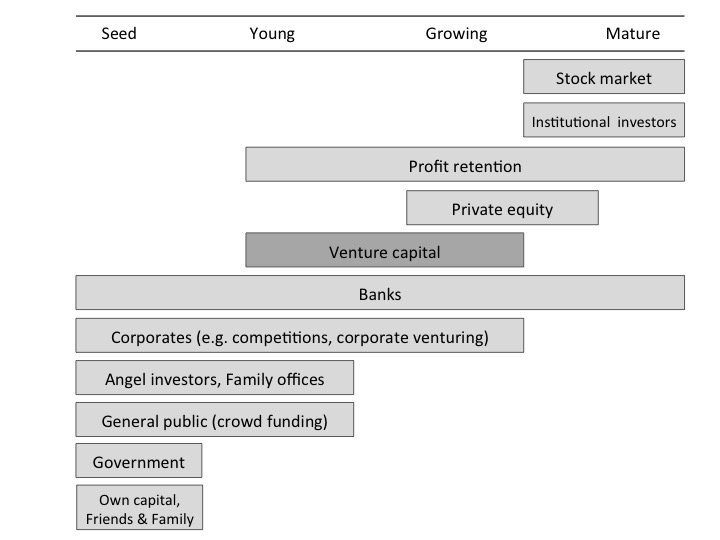

Venture capitalists have a special role to play as they usually invest during the more risky stages of doing business – when businesses are still relatively young and the business benefits are not yet fully crystalized. This research has focused on ‘pragmatic idealists’ – in short, those that want to change the world positively, but also want to make good business out of this.

Figure 1. Role of venture capital. Source: Bocken (2015) based on Marcus et al. (2013)

Key people in the industry were interviewed over a period of a couple of months in 2013. These ‘sustainable venture capitalists’ either started to work on this area because they see themselves as ‘practical idealist’, they disagree with the status quo, or they want to help mainstream sustainable businesses. Some are motivated by fear or a personal epiphany (e.g. having their first child).

Figure 2. Pragmatic idealists. Source: Bocken (2015)

Innovation in the business model, collaboration, and a strong business case were found to be key reasons for sustainable start-up success. Failure often happens due to the fact that ‘start-ups just fail’ (about 9 in 10 as mentioned by some of the experts), but a strong existing industry is also important. On the investor side, there may be only a few suitable and willing venture capitalists to invest in sustainable ventures, because of a short-term investor mindset and a search for quick-win-formats (e.g. apps).

There is plenty of opportunity for large businesses to collaborate with start-ups by acting as an R&D partner of serving as a major customer. Entrepreneurs are already challenging existing business models (e.g. Airbnb, Zipcar, and numerous new service models, and sharing models (e.g. Peerby and Yerdle), which can eventually make existing business models obsolete. There is also opportunity in new forms of financing such as crowdfunding and peer-to-peer lending. In the end venture capitalists should plan for potential slower returns, in favour of positive societal and environmental benefits.

The full article can be found here:

Bocken, N. 2015. Sustainable venture capital – catalyst for sustainable start-up success? Journal of Cleaner Production (in press) http://www.sciencedirect.com/science/article/pii/S0959652615006460 (open access)

Other sources:

Marcus, A., Malen, J., Ellis, S. 2013. The Promise and Pitfalls of Venture Capital as an Asset Class for Clean Energy Investment: Research Questions for Organization and Natural Environment Scholars. Organ. & Environ, 26 (1), 31-60.